Good morning my friend!

My husband and I are yin and yang in so many ways. He’s practical, I’m whimsical. He’s the planner, I’m the spontaneous one. He’s a “let’s think ahead” guy, I’m a “let’s trust the universe” girl. We have harmonious balance, but I’m sure for him, my way of skipping through life is frustrating. This magical, spiritual, and pragmatic combination we have helps up always land on our feet.

But one thing we are not opposing forces on: paying our bills on time. After spending two weeks in Japan and completely blowing our budget, we are now in recovery mode. The bills are getting paid, and yes, we have to dip into our line of credit. It’s fine, my sunny self says. We’ll recover. We built memories and ignored the bank balance. That is a worthy endeavour. We will land on our feet, I repeat. The money will come again.

Now that we have some interest-bearing payments to make, it might not make sense to shut off paid subscriptions to this newsletter, but I’ve been having a hard time coming up with special content to deliver on a regular basis to paid subscribers. If I can’t give you what I’ve promised, I need to turn off that tap.

Money is something no one ever talks about but I’m going to, because I have money trauma. I kind of hinted at that in a newsletter a year ago. My money trauma is centred around never having enough to survive, the result of growing up in a single working mom household. So whenever I have a big bill to pay, I spiral into fear. I’ve been working on changing this for a couple of years, and what I’m doing—acknowledging the trauma and its source, then telling myself I’ll find a way through it—is working. As the credit card bills from Japan start coming in, I pay them, then accept the overspend. I repeat my mantra: we will recover, we will land on our feet.

Still, anxiety creeps in. My legal work is drying up; the reasons why are only guesses. Book sales are super slow and low. Cost of living is increasing. Everything—insurance, cost of borrowing, groceries, gas, electricity, property tax—is getting more expensive. Thrift stores, once the beacon of frugal shopping, are now digging deeper into our pockets.

I’m not sure if this feeling that we’ll be fine, that the universe will deliver, is delusional or valid. I’m working on building new streams of income and work is trickling in. (Note to teachers: next month I will be launching a novel study guide for my middle grade novels on Teachers Pay Teachers. Let me know if you want to be notified.) We’re heading into market season, which always helps pad the bank account a little. Owl’s Nest Books added Katya Noskov’s Last Shot to their annual Book Club Discussion Night where their staff present their favourite book discoveries, and they are blowing through inventory. I’m still booking signings at local Indigo and Chapters stores. A book club wants to place an order for multiple copies.

We’ll be fine. We’ll land on our feet.

Related: We are selling our trailer.

For a little while, we need to turn off the money spigot and tighten the taps. Bleed out a little less. Walk back the Amazon orders. Choose to eat the food we have in the freezer instead of ordering Skip. It’s not a hardship, it’s just normal life.

xo Dana

What I’m reading

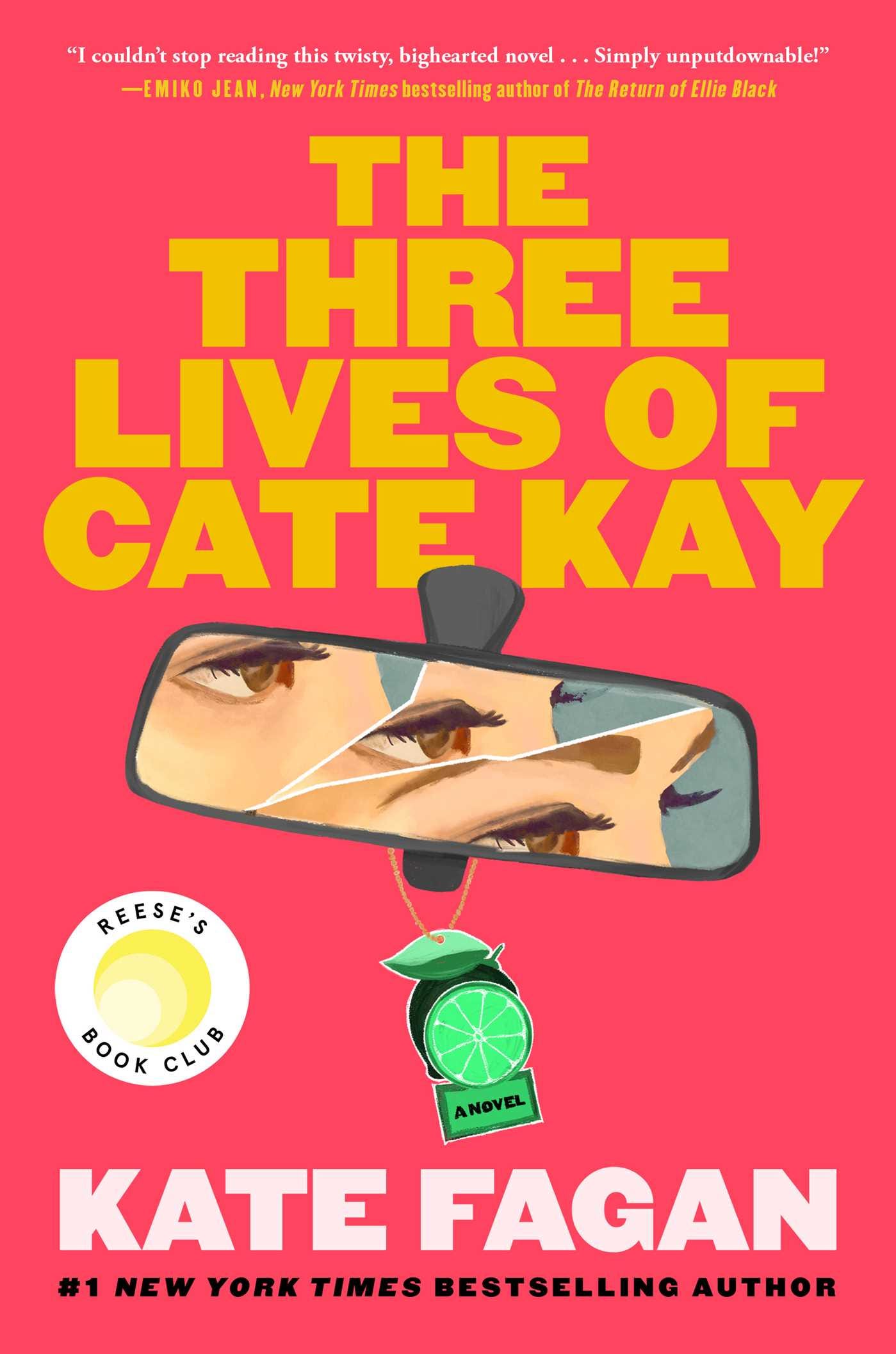

I’m 72 pages into Kate Fagan’s The Three Lives of Cate Kay and I have no idea what to think. So many points of view. A fractured timeline that jumps all over the place. A turn of events on page 60. A perpetual guessing game of the true identity of Cate Kay. I’m not loving it, but I am hugely intrigued. That’s the point right? To keep me turning the pages. It’s working.